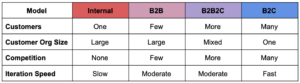

One reason why product management is so complex is that context matters. Different product distribution models fundamentally change the way that products are built, validated, and launched.

When I visualize the different product distribution models, I think of a spectrum from left to right:

On the left are internal products. These are typically platform products or internal productivity tools, and they typically have only a single customer: the hiring organization.

On the right are consumer products. The most notable brand names are typically consumer products: Facebook, Google, Apple.

B2B products, such as Salesforce and ADP, lean towards the left of the spectrum. They exhibit many of the characteristics that internal products do.

B2B2C products, such as Amazon and Airbnb, lean towards the right of the spectrum. They exhibit many of the characteristics that B2C products do.

While many product managers will stick with one distribution model for their entire career, others will be exposed to a variety of product distribution models.

The very best product managers understand the differences between each model and understand the constraints and benefits that come with each.

So, let’s talk about how each aspect of product development differs for product managers, based on the product distribution model being used.

For our discussion, I’ll focus on the two extremes of the product distribution model spectrum – internal products on the left, and B2C products on the right.

Product Distribution Models

These are the most common product distribution models:

1. Product Sales Model

This product distribution model consists of product sales to the end-user. The product is sold directly by the product manager, or an intermediary product manager, such as a distributor or dealer. Distribution product management represents the link to other product managers that are responsible for product support and product service (product service product managers).

2. Product Referral Model

In product referral product management, product sales are generated by word of mouth. The product is sold via a product manager to end-users. These product managers are usually part of an affiliation network, with referrals emanating from individuals who have used the product successfully on their own initiative or through employing the product in collaboration with other product managers (such as dealers).

3. Product Placement Model

This product distribution model is used when product sales are generated by product managers’ placement of products on retail store shelves (see product manager, product supply chain management). A product may be product placed in retail stores via the product placement model while in the product development stage. In this case, a product manager obtains approval for their product to be product placed before product launch.

Alternatively, product placement can occur afterward, in which case product managers seek the approval of store managements or product brokers to carry their products on the retail stores’ shelves. Product positioning is not used for this product distribution model.

4. Product Auction or Bidding Model

In product auctions or product bidding, product managers create product packages that are highly desirable to product buyers. Product auctioning can be product used in a wide range of product markets and product categories. Auction models can use either real-time online auctions or more traditional product auctions where bidders drop their bids off at the store location or submit over-the-phone product auction bids.

5. Product Licensing, Franchising, and Co-Branding Models

Product licensing is a product distribution model product managers use when a product they want to distribute can be sold under an existing product brand name and product logo. Product licensing for products is usually done through product manufacturers’ product line extensions.

Product franchising is a product distribution model used when selling products through product distributors that have already been established in the market. This product distribution model product managers use when product is sold through product franchises to increase product awareness and product market presence.

Co-branding is a product distribution model used by manufacturing companies, using their product brand name along with the product name of other firms, either through licensing or franchising agreements.

6. Product Rental, Leasing, and Time-Sharing Models (marketplace)

Product rental or product leasing is a product distribution model, where the product is either rented to consumers at initial purchase or leased over time. Product managers decide to use product rental or product leasing for capital equipment and durable products that are used in the process of manufacturing a product.

Product rentals may be managed by the manufacturer directly or outsourced to product rental companies. Product rentals can be an effective product distribution model for product managers who want to make their products available to customers without creating inventory.

Product leasing is similar to product rental but allows the customers a prolonged use of capital equipment or durable products in exchange for regular payments over time. Product managers use product leasing when they want to provide product financing for their product. Product leasing is most effective when the product manager’s customers can recognize that keeping a product longer will save them money.

How Distribution Models Change Product Management

This is how different product distribution models can change product management in 2024 and onwards.

1. User Research

When conducting user research for an internal product, you’re essentially taking a census of the population. Given that there is only one customer – the hiring organization – you only have to focus on that one customer.

User research for internal products is fascinating, because you’re working with a user population that is entirely captive as an audience.

On top of that, these users are your colleagues at work, which means that you must learn to interact with colleagues as stakeholders and as customers.

Interestingly, internal product management typically focuses heavily on processes and jobs-to-be-done and focuses much less on personas or ethnographic research.

After all, since everyone is a colleague within the same organization, you already have strong context on your users’ values, mental models, goals, and contexts.

Contrast this with B2C consumer product management.

Given that you have a user base of literally millions of people, you can never conduct a census of the population.

You can only ever sample your customer base to drive insights.

In consumer product management, because you’re not part of the same organization that your users are, much of your research will focus on getting the context behind how the user thinks.

Your goal in conducting consumer user research is to understand your users’ pains, values, mental models, and goals.

On top of that, you won’t know immediately what kinds of users are out there, and you’ll only be able to discover it through user research.

Given that you can only sample the population, it’s crucial that you find ways to draw representative samples.

Otherwise, if you pick a biased sample, you might build for a customer base that isn’t actually there in the real world.

Again, this is different from internal product management, where you already know what kinds of users you have, where users are happy to proactively provide you their pain, and where you can get access to users informally at any time.

2. Validation and Velocity

For internal products and for B2B products, you have very little tolerance for error.

Internal products and B2B products typically touch workflows that change the way that work happens. That means that if your product isn’t performing well, you’re hurting your customers’ ability to generate revenue.

Given that constraint, it’s pretty common to see multiple protracted cycles of validation for internal products.

For example, you might see an internal product manager take an entire quarter to get executive buy-in on a new flow, with weekly check-ins and approvals before they can release the product.

On the other hand, most B2C products don’t generate revenue for the end-user. After all, most consumers aren’t running their businesses off of Facebook, Instagram, or Amazon.

Therefore, the tolerance for error is quite high, which means that you can ship quickly without many consequences. Since most B2C product bugs won’t introduce a financial cost to the end user, they’re usually quite forgivable.

When working on B2C products, speed is far more important than correctness.

With speed, you can discover the correct solution much faster than trying to conduct validation with multiple rounds of users – and even if you did get validation from one set of users, another set of users might object.

Your focus for B2C products will be in generating hypotheses, prototyping, shipping, and learning. You don’t need to get the product right the first time, since you won’t significantly damage user trust, and user trust is easy to regain.

For internal products and B2B products, as soon as you lose trust, your customer is highly likely to fire your product and to permanently reject using it again even if you fix the problem. According to the product experts in the PMHQ community, that’s because internal products and B2B products introduce significant financial risk to the customer, and they need to know that they can rely on you every step of the way.

3. Competition

Internal products rarely have any competitors at all. Internal products are targeted towards the unique pains of the organization and typically have company-perfect product/market fit.

It’s hard to displace an internal product with an external solution because external solutions must solve for a variety of users, whereas internal products serve only a single organization and can be tuned to fit the exact needs of the company.

In other words, internal products have incredibly high barriers to entry and have high switching costs.

But, given that internal products rarely have competition, it’s sometimes quite difficult to ideate or to push back against your stakeholders when they attempt to solve on your behalf. After all, there’s no one else in the space, so you can’t take inspiration from your competitors.

B2B products are similar to internal products, in that there are typically only a handful of competitors out there. It’s hard for many companies to have the scale and the process needed to sell to businesses.

B2B product teams need to have the organizational muscle of clearing customer procurement processes and vendor reviews for legal and information security concerns, and this organizational muscle takes significant time and expertise to develop.

On top of that, to win in the B2B space, you have to win over at least three separate personas within your customer: the decision-maker (purchaser), the project sponsor (implementor), and the end-user.

Therefore, it’s hard to break into the B2B space. The barrier to entry is high, so the competition is scarce.

On the flip side, for B2C products, the barrier to entry is quite low. All you need to do is to convince an end-user to try the product, whether it’s to visit your product website or whether it’s to download your mobile app.

End users are beholden to no one else, and so you only need to convince “organizations” where the decision-maker (purchaser), the project sponsor (implementor), and the end-user are all the same person.

That means that B2C products have intense competition because it’s so easy to break into the market. For example, think of the proliferation of mobile game apps.

Given that the competition is high, you can draw inspiration from your competitors. Furthermore, you can push back against end-users that you won’t implement a feature that they want because they have so little negotiation power against you.

4. Go to Market

To successfully deliver an internal product or a B2B product, you have to account for change management.

Since you’re creating functionality that impacts the way people work, you need to retrain them so that they know how to actually use your product.

UX design isn’t enough to drive adoption – you need to work alongside change champions within your targeted organizations so that you can actually get adoption of the product.

On top of that, you can’t rely much on virality to help drive distribution.

Word of mouth is virtually non-existent for internal products and only the word of mouth of customer executives matters for B2B products. In other words, the word of mouth from end-users doesn’t drive significant value for B2B products.

For B2C products, your end users are beholden to no one, and so change management doesn’t matter.

Your focus here is to have your product design drive the onboarding of the user.

You can’t write up user manuals and you can’t create webinars or training classes to drive adoption, since these consumers are highly unlikely to invest that much time into learning your product vs. just selecting a different competitor.

Virality is incredibly important for B2C products because each end-user has the potential to activate multiple other end users, and all of those end-users in turn can activate even more.

5. Post-Launch Optimization

You can’t A/B test internal products because your entire organization will be trained on the product. So, if you create an A/B test, you create inconsistency in your organization’s processes.

Remember that organizations solidify their competitive advantages through their processes. Therefore, inconsistent processes undermine your organization’s competitiveness.

Similarly, it’s hard to A/B test B2B products because entire organizations are trained on the same product.

Therefore, to drive optimization of your product for internal product distribution models or B2B product distribution models, you need to conduct multiple deep dives with customers to gather their qualitative feedback.

It’s less about running experiments and more about understanding how your product interacts with the customer organization. Therefore, building relationships with your customer is critically important.

Furthermore, in internal product management, it’s nearly impossible to be quantitative because measuring output can be incredibly difficult.

The only way you’ll be able to optimize the product post-launch is to personally observe how your product is working in the wild and to get direct feedback from the organizations that you work with.

For B2C products, there’s simply too much noise if you listen only to qualitative end-user feedback.

You can’t possibly interview that many customers, and given the diverse population that you serve, you’re likely to get conflicting answers across your interviews.

Therefore, the best way to further optimize your product is to conduct A/B testing to see what works the best. That way, all of the qualitative noise cancels out as you observe the total quantitative impact of any changes that you make.

On top of that, you can conduct cohort analyses much better in B2C, and you can be a lot more quantitative and fine-grained in making product decisions.

Summary

The distribution model of a particular product significantly changes the way in which the product is developed.

Regardless of what kind of product manager you currently are, it’s helpful to understand how different product distribution models operate.

After all, these can provide you with inspiration for how to drive more success of your own product, and give you leading indicators of whether you could be better suited to a different product distribution model.

Have thoughts that you’d like to contribute around product distribution models? Chat with other product managers around the world in our PMHQ Community!